Businesses and homeowners whose properties were damaged during the unrest following the death of George Floyd have the opportunity to access low-interest loans made available by the federal government.

The U.S. Small Business Administration recently approved Gov. Tom Wolf’s request for a disaster declaration, freeing up money for the program. Wolf wrote a letter to the agency Thursday seeking help.

State officials said businesses and nonprofits in Philadelphia, as well as those in Delaware, Montgomery and Bucks counties, can borrow up to $2 million in disaster loans to help pay for damaged buildings, inventory and equipment.

“We’re grateful the SBA agreed that this financial assistance is vital to repair or replace property,” Wolf said in a statement. “These low-interest loans will go a long way in helping businesses to recover.”

Homeowners can also receive loans of up to $200,000. Anyone with damaged or destroyed personal property, including cars, as a result of unrest may be able to get a maximum of $40,000.

Economic Injury Disaster Loans, which are used to pay fixed debts, payroll and other bills, may also be available to businesses, according to Wolf’s office.

Only businesses that were damaged during violent protests that occurred between May 30 and June 8 are eligible for the program. It will not cover losses due to the novel coronavirus pandemic.

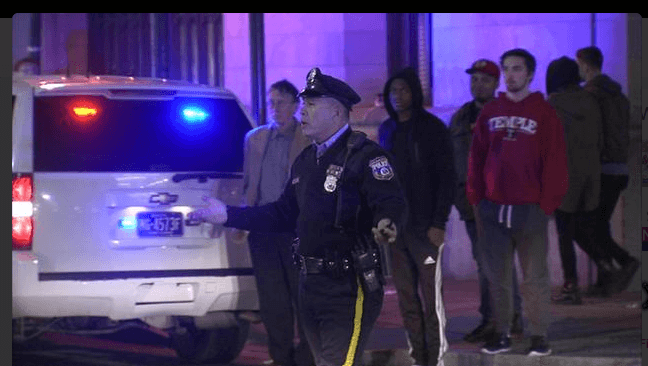

Floyd’s death at the hands of Minneapolis police sparked peaceful protests throughout the city in late May and early June. Those demonstrations were accompanied by widespread looting, fires and ATM explosions.

Emergency crews responded to 378 fires, including at least 14 arsons, just on May 30 and May 31, authorities said at the time.

The SBA loans offer long-term repayment options, up to 30 years. Specific terms are on a case-by-case basis, state officials said.

Wolf’s office said the application period will open Monday at 8 a.m.

A Virtual Disaster Loan Outreach Center operated by the SBA will be open from 8 a.m. to 5 p.m. Monday through Friday.

Anyone interested finding out more or applying can call 202-803-3307 or 470-363-5936, email [email protected] or go to https://disasterloanassistance.sba.gov.

The deadline for the loans covering physical damage is Oct. 6, and the Economic Injury Disaster Loans will be available until May 7.