By David DeKok

HARRISBURG, Penn. (Reuters) – Pennsylvania Governor Tom Wolf proposed a $29.9 billion budget on Tuesday that includes $2.5 billion of net tax increases for fiscal 2016.

Wolf’s sweeping revamp of the state’s tax system would raise sales and personal income taxes while lowering property and corporate taxes, he said during his address to lawmakers.

The budget would implement a 5 percent tax on the state’s booming natural gas extraction industry, using the estimated $1 billion of annual revenues to increase public education funding, as Wolf has promised since taking office in January. “Pennsylvania will not improve until it rebuilds the middle class,” Wolf said.

He also wants to increase the state’s share of local education funding from the current 35 percent to 50 percent, a level not seen in about four decades.

Wolf’s speech attempted to address myriad problems facing the state, from a sluggish economy to pension underfunding and a $2.3 billion budget deficit.

The Democrat beat incumbent Republican Governor Tom Corbett in November, in part because voters believed Corbett had slashed funding to education.

Overall, the total tax burden on the average middle class homeowner would drop 13 percent under Wolf’s plan, he said, calling his tax plan “smart, pragmatic and fair.”

Wolf proposed hiking Pennsylvania’s personal income tax rate to 3.70 percent from the current 3.07 percent while cutting property taxes by $1,000 annually for the average homeowner, he said.

He also wants to reduce the corporate net income tax rate to 5.99 percent from 9.99 percent in January 2016, and to 4.99 percent by January 2018, while closing major business tax loopholes.

Republicans, who lead the state legislature, did not agree with Wolf’s overall proposal, saying it would actually increase taxes over the next two fiscal years by $1,000 for every person in Pennsylvania. “Governor Wolf is fixated on taxing and spending his way out of the state’s problems,” said Senate President Pro Tempore Joe Scarnati in a statement.

Wolf also wants to save nearly $1.3 billion over the next five years by reducing “excessive fees to Wall Street managers” for the state’s public pension system.

“Simply investing this money in a safe, conservative account would produce a similar return over the long term,” he said.

And he called for the state to issue $675 million of bonds to pay for energy, manufacturing and economic development loans.

(Reporting by David DeKok in Harrisburg and Hilary Russ in New York; Editing by Alden Bentley and Cynthia Osterman)

Pennsylvania governor proposes tax system revamp in $29.9 billion budget

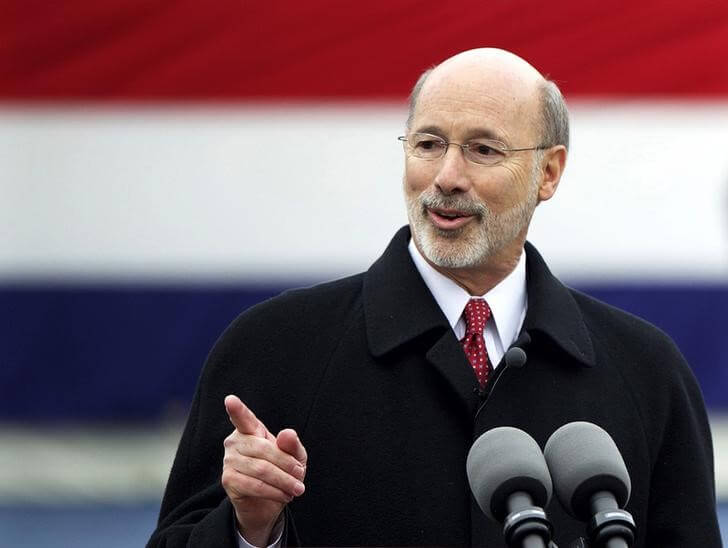

Gov. Tom Wolf.

REUTERS/Mark Makela