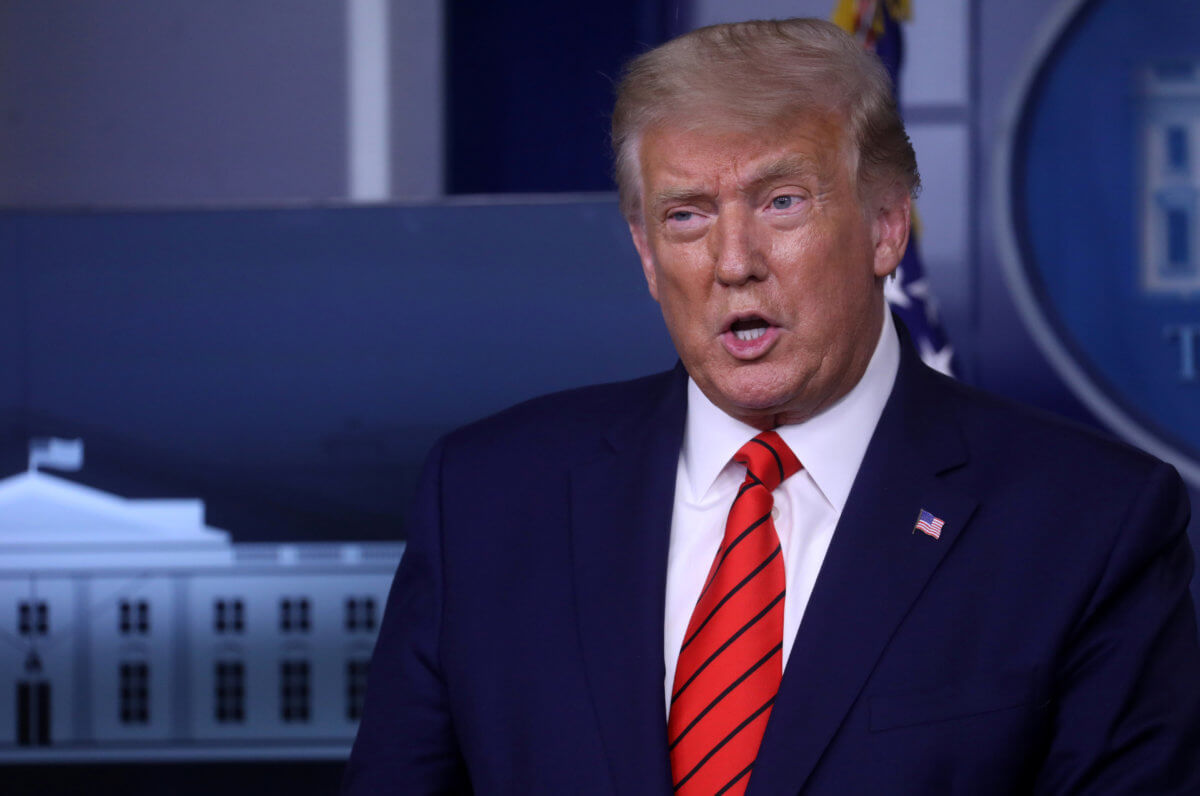

A federal appeals court expects to decide later on Tuesday whether to grant President Donald Trump’s request to block Manhattan’s district attorney from accessing his tax returns in connection with a criminal probe of his business practices.

At a hearing, judges from the 2nd U.S. Circuit Court of Appeals in Manhattan suggested possibly giving Trump and District Attorney Cyrus Vance a few weeks to submit briefs on the merits of an Aug. 20 lower court ruling ordering the handover of the returns.

Trump is seeking to stay that ruling while he appeals.

The president has spent a year fighting a grand jury subpoena from Vance of his longtime accounting firm Mazars USA for eight years of personal and corporate returns.

If the appeals court refuses a delay, Trump plans to ask the U.S. Supreme Court to intervene.

That court refused in July to block the subpoena, rejecting Trump’s claim of immunity from criminal probes while in the White House, but said he could raise other objections.

Trump later claimed that the subpoena from Vance was “wildly overbroad” and issued in bad faith.

William Consovoy, a lawyer for Trump, argued that giving Vance a chance even to see the returns would cause the president irreparable harm.

“The status quo can never be restored,” he said. “We can’t make them forget what they learn.”

Carey Dunne, a lawyer for Vance, downplayed that concern. “The toothpaste can be put back into the tube sufficiently to protect people’s rights,” he said.

Vance began his probe after news that Trump’s former lawyer Michael Cohen paid pornographic film actress Stormy Daniels $130,000 to keep quiet before the 2016 election about claimed sexual encounters with Trump, which the president has denied.

Circuit Judge John Walker questioned whether it was premature to assess Trump’s claim the subpoena was too broad.

“It seems to me … there is no way to really measure an overbreadth,” he told Dunne. “It’s breadth over what?”